3 questions to ask before applying for SR&ED tax incentives

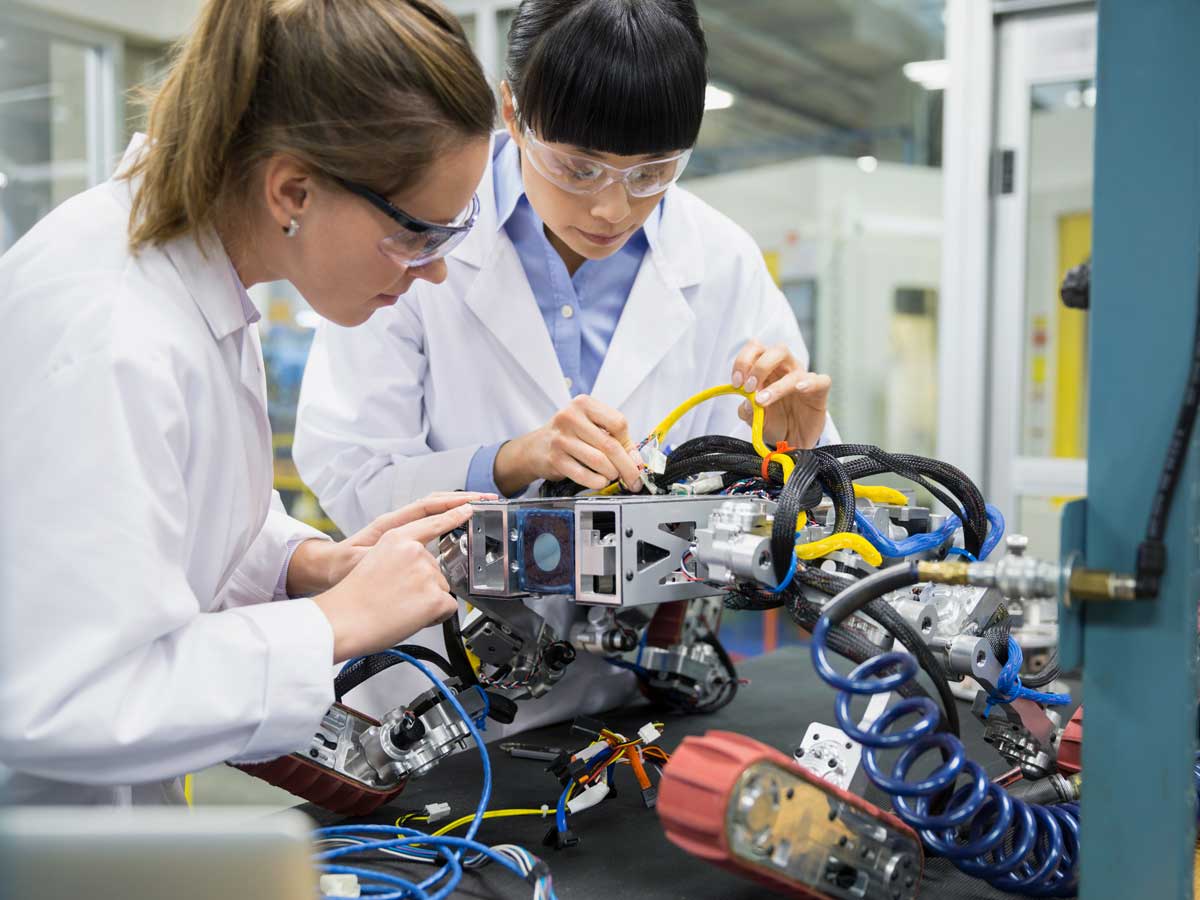

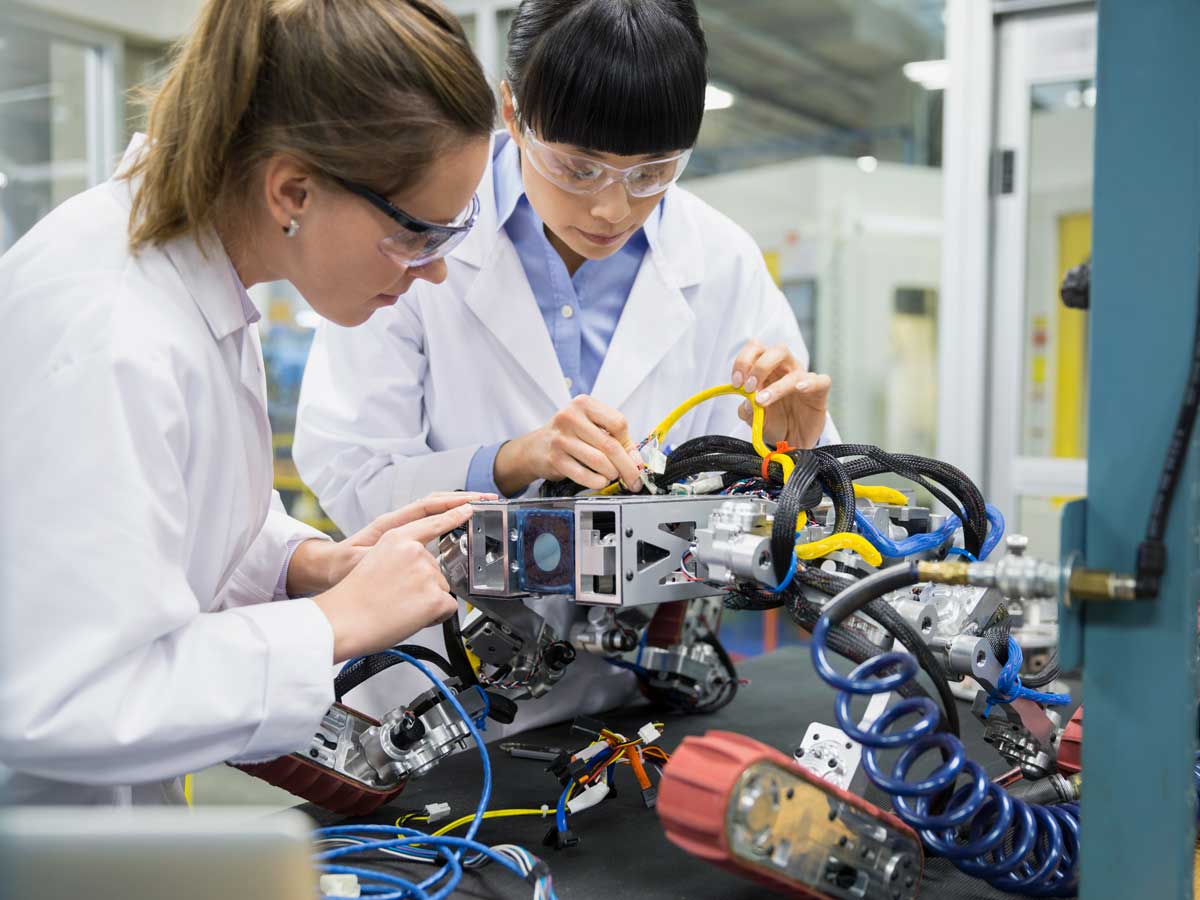

If the company puts everything together and it works, the good news is that it has a functional plastics sorting process. The bad news: it’s not considered to be a SR&ED project—they plugged it in and it worked, so there was no need for experimentation, no technological uncertainty. (Getty Images/Hero Images)

If the company puts everything together and it works, the good news is that it has a functional plastics sorting process. The bad news: it’s not considered to be a SR&ED project—they plugged it in and it worked, so there was no need for experimentation, no technological uncertainty. (Getty Images/Hero Images)

The Scientific Research and Experimental Development (SR&ED) program uses tax incentives to encourage Canadian businesses of all sizes and in all sectors to conduct research and development in Canada. That’s the good news. The bad news is, there are strict rules that determine whether an initiative actually qualifies for SR&ED. We asked tax expert David Douglas, principal, Canadian practice leader scientific research and experimental development at Ryan, for some tips on how to get those tax credits on SR&ED expenditures.

There are three major questions the CRA considers, he says.

1) Is there a scientific or technological uncertainty?

Say, for example, a company wants to develop a new process for sorting plastics for recycling. So the company brings in equipment designed for other purposes (perhaps optical recognition equipment, AI tools and conveyors), and puts it all together. While this solution is innovative, it may not be considered a SR&ED project, Douglas says. Why not? Because, he says, “if achieving the objective of a functional system is well within the company’s technical capabilities, then there may not be a technological uncertainty until the point in the project at which the company can demonstrate specific unknowns, challenges or obstacles requiring experimentation to overcome.”

If the company puts everything together and it works, the good news is that it has a functional plastics sorting process. The bad news: it’s not considered to be a SR&ED project—they plugged it in and it worked, so there was no need for experimentation, no technological uncertainty. “Failure is bad for business, good for SR&ED,” Douglas says.

2) Was there systematic investigation or experimentation to resolve the technological uncertainty?

In this, scientific method is your friend: form a hypothesis, test the hypothesis, look at results, rinse and repeat. Failures highlight the technological uncertainty, force you to revisit the hypothesis and try again. As Thomas Edison famously said when quizzed about his repeated failure to design a working lightbulb, “I have not failed. I’ve just found 10,000 ways that won’t work.”

But the CRA sees simple trial and error as a non-systematic approach; in fact the term “trial and error” is anathema at the CRA, Douglas says.

“Companies that are entering into big projects like this, that exhibit technical risk that they’re trying to work through, can help themselves by being more attuned and documenting and making notes, having minuted meetings and project charters that demonstrate what their thoughts are as to what is expected to be the outcome of this in very specific terms,” he explains. “Then when it changes and doesn’t happen and they get failures and they get iterations, then that helps them to demonstrate the painful process they went through, which is the subject of the SR&ED. SR&ED pays for the pain.”

3) Was there technological advancement?

The SR&ED supports companies that are experiencing that pain, says Douglas. However, those organizations that have a higher knowledge base and capabilities than their peers are, in a sense, penalized because it’s all about incremental improvements to the company’s knowledge base and capabilities. No one likes to focus on their capabilities at the lowest level, he adds.

“[Companies should] be very realistic in and specific about what are their base level capabilities with respect to this kind of work that’s about to be undertaken,” advises Douglas. “Because that helps to set up the technical risk and helps to set up that this is beyond our capabilities given our current knowhow, and that it’s different in terms of our current methods, approaches or techniques, and therefore we have to experiment to get to our technological advancement.”

Another important factor is to find the right level at which to carve out a SR&ED project from the larger “commercial” initiative. At the lowest levels, Douglas explains, finding eligibility is problematic because it appears to be routine activity. If the level is too high, it doesn’t describe a sufficiently specific technological uncertainty. “‘We don't know how to do this’, or ‘have never done this before’, isn’t descriptive enough,” he says.

Documentation is critical—the more specific, the better and quality definitely rules over quantity. “The more things you can do to track the level of activity associated with the SR&ED project the better,” he says. Douglas advises setting up an SR&ED mailbox and forwarding emails about project activities to it to create an easily accessible record.

“So, activity logs, photos and the more evidence provided as to who was involved, what were they doing, over what period of time, what was the depth of their involvement, evidence of their analytical input, all those things will help to qualify,” he says. “And if you do have time records that are associated with the project, you’re able to cast the umbrella more widely as to the supporting activities on the project, which is where your money is.”

GET IN THE GAME

Learn the fundamentals of SR&ED with CPA Canada’s online course that presents an overview of the federal and provincial SR&ED programs from expenditure categories to compliance requirements.